|

|

Investing Basics

|

| Types of Investments: Stocks When you buy a company's stock, you're purchasing a share of ownership in that business. You become one of the company's stockholders or shareholders. Your percentage of ownership in a company also represents your share of the risks taken and profits generated by the company. If the company does well, your share of its earnings will be proportionate to how much of the company' s stock you own. The flip side, of course, is that your share of any loss will be similarly proportionate to your percentage of ownership. | | More Details |

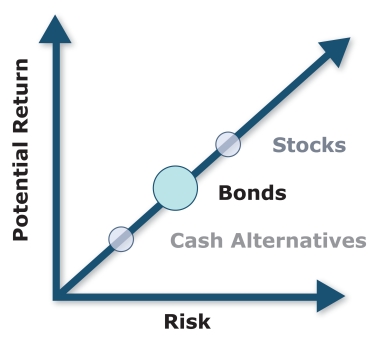

| Types of Investments: Bonds When you buy a bond, you're basically buying an IOU.

Bonds, sometimes called fixed-income securities, are essentially loans to a

corporation or governmental body. The borrower (the bond issuer) typically

promises to pay the lender, or bondholder, regular interest payments until a

certain date. At that point, the bond is said to have matured. When it reaches

that maturity date, the full amount of the loan (the principal or face value)

must be repaid.

| | More Details |

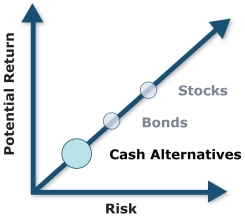

| Types of Investments: Cash In daily life, cash is all around you, as currency, bank balances, negotiable money orders, and checks. However, in investing, "cash" is also used to refer to so-called cash alternatives: investments that are considered safe and can be converted to cash quickly. Common cash alternatives include savings accounts, money market accounts, certificates of deposit, guaranteed investment contracts (GICs), government savings bonds, U.S. Treasury bills, Eurodollar certificates of deposit, commercial paper, and face amount certificates. | | More Details |

| Investing Through Mutual Funds and ETFs You can invest in all three major asset classes through mutual funds, which pool your money with that of other investors. Each fund's manager selects specific securities to buy based on a stated investment strategy. | | More Details |

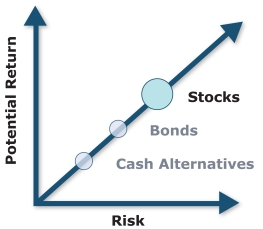

| Asset Allocation The combination of investments you choose can be as important as your specific investments. The mix of various asset classes, such as stocks, bonds, and cash alternatives, account for most of the ups and downs of a portfolio's returns. | | More Details |

|

|

|

IMPORTANT DISCLOSURES Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual's personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice. |

| Prepared by Broadridge Investor Communication Solutions, Inc. Copyright 2025. |

|