Raymond James & Associates, Inc.

Wilmarth Private Wealth Management

Steven T Wilmarth, CEP®, WMS®

Managing Director

202 N. Harbor City Blvd.

Suite 301

Melbourne, FL 32935

321-253-7911

877-210-0769

steve.wilmarth@raymondjames.com

www.wilmarthpwm.com

| |

| |  |

|

Loss of a Spouse

|

|

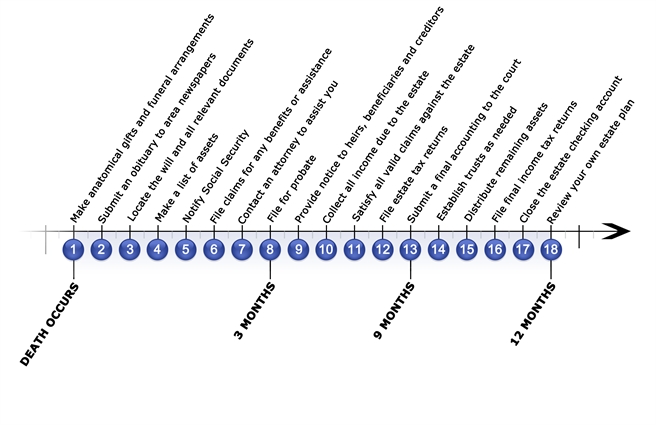

The Probate Process - In the event the decedent made no provision for anatomical gifts, many states allow you to make that decision. In most jurisdictions, the funeral director can obtain certified copies of the death certificate for you (you will need several copies).

- Word of mouth may not travel in time for the funeral.

- Locate the will, birth certificate, marriage certificate, Social Security card, and any other relevant documents.

- Note the location and value (you may need to retain an appraiser) of all real estate, insurance policies, jewelry, and other assets. Make sure assets are adequately insured.

- Inform the Social Security Administration to stop payments that were being made to the decedent. Inquire about survivor's benefits.

- Investigate the existence of any veteran's benefits, private pensions, or life insurance and make claims at this time.

- Contact an attorney to assist you. He or she can help you determine whether probate is needed.

- Petition the appropriate court for probate.

- Place a legal notice in the paper to notify unidentified heirs and creditors. Contact named beneficiaries and known creditors directly.

- For example, if the decedant owned investment property, rents will need to be collected.

- This includes expenses, debts, and bequests (paid out in that order). Court permission may be required before writing checks through the estate account--keep meticulous records.

- The federal estate tax return is due nine months after the date of death. State filing deadlines vary, so check with the appropriate state agency.

- This is necessary to close the probate proceedings and relinquish the executor's duties.

- Set up any trusts as outlined in the will.

- Distribute remaining assets to all beneficiaries.

- The federal income tax return is due on tax day (typically April 15) of the year following death. State filing deadlines vary, so check with your local tax office.

- Notify the bank to close the estate checking account.

- Review and update your own estate plan.

|

|

|

|

|

Raymond James & Associates, Inc., member New York Stock Exchange/SIPC

This information, developed by an independent third party, has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. This information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. This information is not intended as a solicitation or an offer to buy or sell any security referred to herein. Investments mentioned may not be suitable for all investors. The material is general in nature. Past performance may not be indicative of future results. Raymond James does not provide advice on tax, legal or mortgage issues. These matters should be discussed with the appropriate professional.

|

| Prepared by Broadridge Investor Communication Solutions, Inc. Copyright 2024. |

|