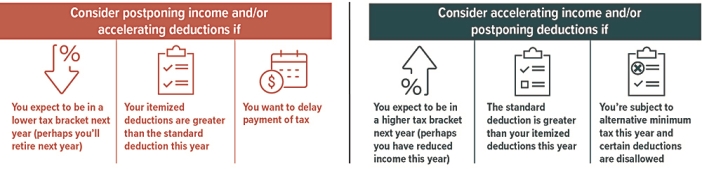

Year-End 2020 Tax TipsHere are some things to consider as you weigh potential tax moves before the end of the year. Defer income to next yearConsider opportunities to defer income to 2021, particularly if you think you may be in a lower tax bracket then. For example, you may be able to defer a year-end bonus or delay the collection of business debts, rents, and payments for services in order to postpone payment of tax on the income until next year. Accelerate deductionsLook for opportunities to accelerate deductions into the current tax year. If you itemize deductions, making payments for deductible expenses such as medical expenses, qualifying interest, and state taxes before the end of the year (instead of paying them in early 2021) could make a difference on your 2020 return. Make deductible charitable contributionsIf you itemize deductions on your federal income tax return, you can generally deduct charitable contributions, but the deduction is limited to 60%, 30%, or 20% of your adjusted gross income (AGI), depending on the type of property that you give and the type of organization to which you contribute. (Excess amounts can be carried over for up to five years.) For 2020 charitable gifts, the normal rules have been enhanced: The limit is increased to 100% of AGI for direct cash gifts to public charities. And even if you don't itemize deductions, you can receive a $300 charitable deduction for direct cash gifts to public charities (in addition to the standard deduction). Bump up withholdingIf it looks as though you're going to owe federal income tax for the year, consider increasing your withholding on Form W-4 for the remainder of the year to cover the shortfall. The biggest advantage in doing so is that withholding is considered as having been paid evenly throughout the year instead of when the dollars are actually taken from your paycheck. More to ConsiderHere are some other things you may want to consider as part of your year-end tax review. Maximize retirement savingsDeductible contributions to a traditional IRA and pre-tax contributions to an employer-sponsored retirement plan such as a 401(k) can reduce your 2020 taxable income. If you haven't already contributed up to the maximum amount allowed, consider doing so. For 2020, you can contribute up to $19,500 to a 401(k) plan ($26,000 if you're age 50 or older) and up to $6,000 to traditional and Roth* IRAs combined ($7,000 if you're age 50 or older). The window to make 2020 contributions to an employer plan generally closes at the end of the year, while you have until April 15, 2021, to make 2020 IRA contributions. (*Roth contributions are not deductible, but Roth qualified distributions are not taxable.) Avoid RMDs in 2020Normally, once you reach age 70½ (age 72 if you reach age 70½ after 2019), you generally must start taking required minimum distributions (RMDs) from traditional IRAs and employer-sponsored retirement plans. Distributions are also generally required to beneficiaries after the death of the IRA owner or plan participant. However, recent legislation has waived RMDs from IRAs and most employer retirement plans for 2020 and you don't have to take such distributions. If you have already taken a distribution for 2020 that is not required, you may be able to roll it over to an eligible retirement plan. Weigh year-end investment movesThough you shouldn't let tax considerations drive your investment decisions, it's worth considering the tax implications of any year-end investment moves. For example, if you have realized net capital gains from selling securities at a profit, you might avoid being taxed on some or all of those gains by selling losing positions. Any losses above the amount of your gains can be used to offset up to $3,000 of ordinary income ($1,500 if your filing status is married filing separately) or carried forward to reduce your taxes in future years. |

IMPORTANT DISCLOSURES

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, or legal advice. The information presented here is not specific to any individual's personal circumstances.

To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable--we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Copyright 2025 by Broadridge Investor Communication Solutions Inc.All Rights Reserved.