Sharing Your Money Values Can Be Part of Your LegacyWhen it's time to prepare the next generation for a financial legacy, you might want to bring your family members together to talk about money. But sitting down together isn't easy, because money is a complicated and emotionally charged topic. Rather than risk conflict, your family may prefer to avoid talking about it altogether. If your family isn't quite ready to have a formal conversation, you can still lay the groundwork for the future by identifying and sharing your money values — the principles that guide your financial decisions. Define Your Own ValuesWhat does money mean to you? Does it signify personal accomplishment? The ability to provide for your family? The chance to make a difference in the world? Is being a wise steward of your money important to you, or would you rather enjoy it now? Taking time to think about your values may help you discover the lessons you might want to pass along to future generations. Respect PerspectivesThe unspoken assumption that others share your financial priorities runs through many money-centered conversations. But no two people have the same money values (even relatives). To one person, money might symbolize independence; to another, money equals security. Generational differences and life experiences may especially influence money values. Invite your family members to share their views and financial priorities whenever you have the opportunity. See Yourself as a Role ModelYour actions can have a big impact on those around you. You're a financial role model for your children or grandchildren, and they notice how you spend your time and your money. Look for ways to share your values and your financial knowledge. For example, if you want to teach children to make careful financial decisions, help them shop for an item they want by comparing features, quality, and price. If you want teenagers to prioritize saving for the future, try matching what they save for a car or for college. Teaching financial responsibility starts early, and modeling it is a lifelong effort. Practice Thoughtful GivingHow you give is another expression of your money values, but if a family member is the recipient, your generosity may be misconstrued. For example, your adult son or daughter might be embarrassed to accept your help or worried that a monetary gift might come with strings attached. Or you may have a family member who often asks for (or needs) more financial support than another, which could lead to family conflicts. Defining your giving parameters in advance will make it easier to set priorities, explain why you are making certain decisions, and manage expectations. For example are you willing and able to:

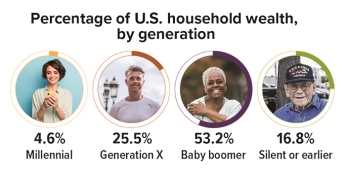

There are no right or wrong answers as long as your decisions align with your financial values and you are sure that your gift will benefit both you and your family member. Maintaining consistent boundaries that define what help you are willing and able to provide is key. Gifts that are not freely given may become financial or emotional obligations that disrupt family relationships. The Great Wealth TransferSeventy percent of U.S. household wealth is held by older generations. Although younger people may be far behind today, they stand to inherit much of this wealth in the coming decades, while also accumulating wealth through their own efforts. Reveal Your Experiences with MoneyBeing more transparent about your own financial hopes and dreams, and your financial concerns or struggles, may help other family members eventually open up about their own. Share how money makes you feel — for example, the satisfaction you felt when you bought your first home or the pleasure of giving to someone in need. If you have been financially secure for a long time, your children may not realize how difficult it was for you, or for previous generations, to build wealth over time. Your hard-earned wisdom may help the next generation understand your values and serve as the foundation for a shared legacy. |

IMPORTANT DISCLOSURES

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, or legal advice. The information presented here is not specific to any individual's personal circumstances.

To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable--we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Copyright 2025 by Broadridge Investor Communication Solutions Inc.All Rights Reserved.