Saving for Retirement Health-Care Costs

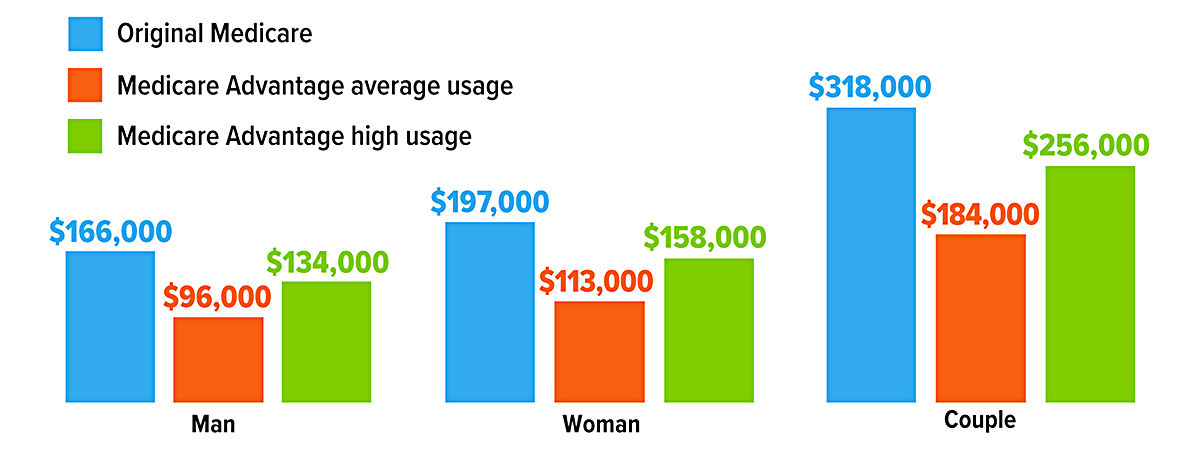

The chart below shows the savings that a man, a woman, and a couple who retired at age 65 in 2022 might need to meet retirement health-care expenses, assuming median prescription drug expenses. The Original Medicare estimate includes premiums for Medicare Parts B and D, the Part B deductible, out-of-pocket prescription drug spending, and premiums for Medigap Plan G, which would pay most other out-of-pocket costs.

Medicare Advantage Plans — offered by private companies under Medicare oversight — require the Medicare Part B premium and typically combine hospital, medical, and prescription drug coverage. They often have limited networks and may require approval to cover certain medications and services.

Source: Employee Benefit Research Institute, 2023. Projections are based on a 90% chance of meeting expenses and assume savings earn a return of 7.32% from age 65 until expenditures are made. Does not include vision, hearing, dental, or long-term care expenses. Some Medicare Advantage Plans require additional premiums, which are not included.