Investors Beware: This Surtax Is Creeping Up on You

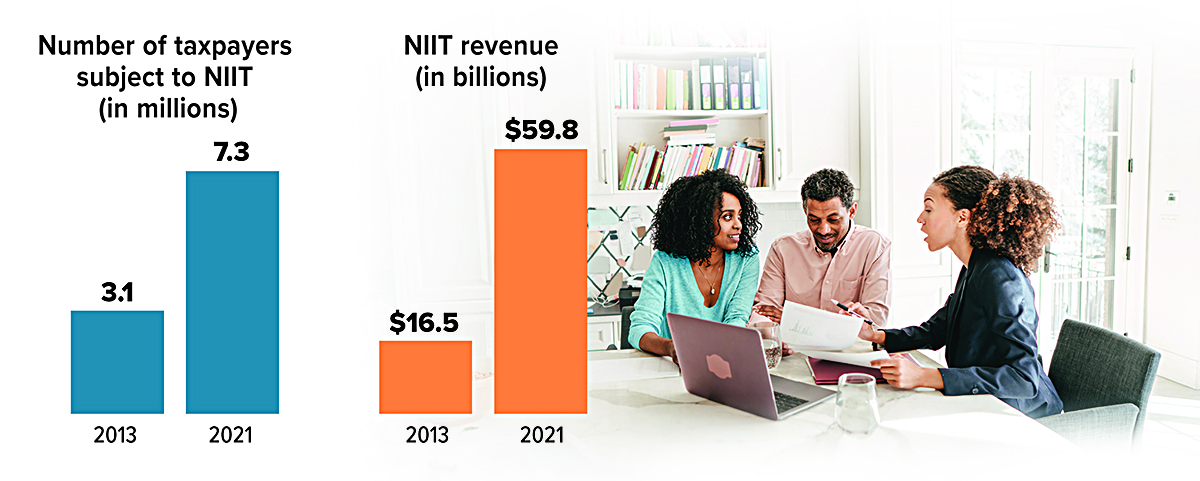

High-income taxpayers are subject to a 3.8% net investment income tax (NIIT) from capital gains, dividends, interest, certain royalties, rents, and passive income if their modified adjusted gross income (MAGI) exceeds $200,000 for single filers or $250,000 for married joint filers. The number of taxpayers paying the NIIT has more than doubled since it took effect, mostly because these income thresholds were not indexed to inflation, and the revenue collected has more than tripled.

Source: Congressional Research Service, 2023 (uses IRS data)