Are You a HENRY? Consider These Wealth-Building Strategies

HENRY is a catchy acronym for "high earner, not rich yet." It describes a demographic made up of young and often highly educated professionals with substantial incomes but little or no savings. HENRYs generally have enviable career prospects, but many of them feel financially stretched or may even live paycheck to paycheck for years, especially if they are working in cities with high living costs and/or facing large student loan payments.

If this sounds like you, it may be time to shed your HENRY status for good and focus on growing wealth — even if it means making some temporary sacrifices. One simple metric that can be used to gauge your financial standing is your net worth, which is the total of your assets (what you own) minus your liabilities (what you owe).

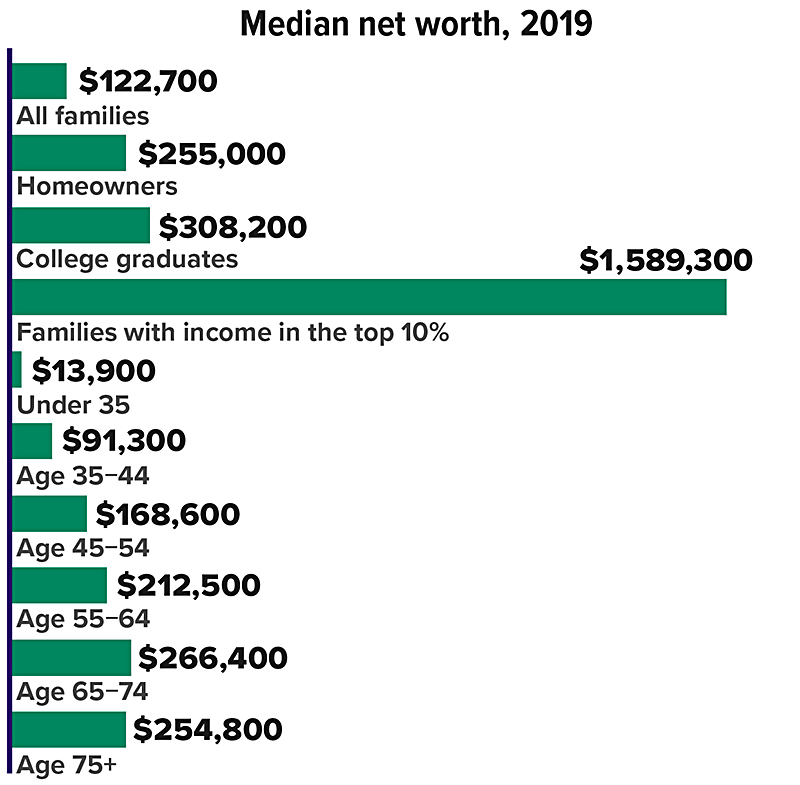

Wealth Snapshot

The net worth of U.S. families varies greatly depending on housing status, education, and income level. But it also takes time to build wealth, so there are significant differences by age.

Source: Federal Reserve, 2021

Pay Attention to Your Spending

It's virtually impossible to increase your net worth if you don't live within your means. After studying long hours and working your way into a good-paying job, you may feel that you deserve to spend some money on fashionable clothes, the latest smartphone, a night on the town, or a relaxing vacation. However, if you can't pay for most of your splurges without relying on credit — or wiping out your savings — then you may need to rein in your lifestyle. Budgeting software and/or smartphone apps can help you analyze your spending patterns and track your financial progress.

Utilize a Workplace Retirement Plan

Making regular pre-tax contributions to a traditional 401(k) plan is a no-nonsense way to accumulate retirement assets, and it helps reduce your taxable income by the same amount. Experts recommend saving at least 10% of your income for future needs, but if that's not possible right away, start by contributing 3% to 6% of your salary to your retirement plan and elect to escalate your contribution level by 1% each year until you reach your target (or the contribution limit). The maximum you can contribute to a 401(k) plan in 2022 is $20,500 ($27,000 if you are age 50 or older).

Many companies will match part of employee contributions, and free money is a great reason to save at least enough to receive a full company match and any available profit sharing. Some plans may require that you remain employed by the company for a certain amount of time before you can keep the matching funds.

Assess Your Housing Situation

Paying rent indefinitely may do little to improve your financial situation. Buying a home with a fixed-rate mortgage could help stabilize your housing costs, and you can build equity in the property over time as your loan balance is paid off — especially if the value appreciates. A home purchase may also afford tax advantages, but only if you itemize rather than claim the standard deduction on your tax return. Interest paid on up to $750,000 of mortgage loan debt is deductible, as are the property taxes, subject to a $10,000 cap on state and local property taxes.

Homeownership is a worthwhile financial goal if you plan to stay put for at least several years. And in many places, owning a home can be less expensive than renting, thanks to low interest rates. But there could be hurdles to overcome, including a hot real estate market, high prices, lingering student debt, and the large chunk of money required for a down payment.

When shopping for a home, resist the temptation to buy more house than you can afford, even if the bank says you can. And don't forget to factor property taxes, insurance, and potential maintenance costs into your buying decisions and household budget.