Tapping Retirement Savings During a Financial Crisis

As the number of COVID-19 cases began to skyrocket in March 2020, Congress passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The legislation may make it easier for Americans to access money in their retirement plans, temporarily waiving the 10% early-withdrawal penalty and increasing the amount they could borrow. Understanding these new guidelines and the other rules for loans and early withdrawals may help you determine if they are appropriate options during a financial crisis. (Remember that tapping retirement savings now could risk your financial situation in the future.)

Penalty-Free Withdrawals

The newest exception to the 10% early-withdrawal penalty allows IRA account holders and retirement plan participants to take distributions of up to $100,000 in 2020 for a "coronavirus-related" reason.* These situations include a diagnosis of COVID-19 for account owners and certain family members; a financial setback due to a quarantine, furlough, layoff, or reduced work hours, and in the case of business owners, due to closures or reduced hours; or an inability to work due to lack of child care as a result of the virus. This temporary exception augments the other circumstances for which a penalty-free distribution is typically allowed:

- Death or disability of the account owner

- Unreimbursed medical expenses exceeding 7.5% of adjusted gross income (increases to 10% in 2021)

- A series of "substantially equal periodic payments" over your life expectancy or the joint life expectancy of you and your spouse

- Birth or adoption of a child, up to $5,000 per account owner

- Certain cases when military reservists are called to active duty

In addition, IRAs (but not work-based plans) allow penalty-free withdrawals for a first-time home purchase ($10,000 lifetime limit), qualified higher-education expenses, and payments of health insurance premiums in the event of a layoff.

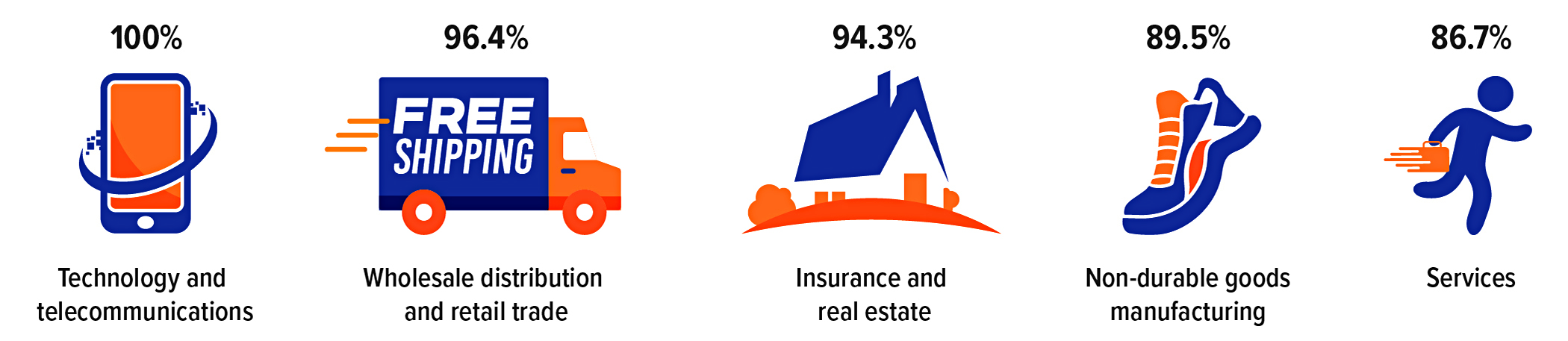

Five Industries Most Likely to Offer Retirement Plan Loans

Percentage of plans that offer loans, by type of industry3

Work-based plans allow exceptions for those who separate from service after age 55 (50 in the case of qualified public safety employees) and distributions as part of a qualified domestic relations order.

Tax Consequences

Penalty-free does not mean tax-free, however. In most cases, when you take a penalty-free distribution, you must report the full amount of the distribution on your income tax return for that year. However, the income associated with a coronavirus-related distribution can be spread over three years for tax purposes, with up to three years to reinvest the money.1

Retirement Plan Loans

If your work-based retirement plan allows loans, you typically can borrow up to the lesser of 50% of your vested balance or $50,000. Most loans must be repaid within five years, but if the money is used to purchase a primary residence, the repayment period may be longer. The CARES Act permits employers to increase this amount to the lesser of 100% of the vested balance or $100,000 for loans to coronavirus-affected individuals made between March 27, 2020, and September 22, 2020.* Affected participants who have outstanding loans on or after March 27, 2020, will be able to delay any payments due in 2020 by one year.2

Hardship Withdrawals

Many work-based retirement plans also permit hardship withdrawals in certain circumstances. Although these distributions are not exempt from the 10% early-withdrawal penalty, they can be a lifeline for people who need money in an emergency.

For more information about your options, contact your IRA or retirement plan administrator.

*Employers do not have to adopt the new withdrawal and loan provisions.