International Investing: Opportunity Overseas?

For the past decade, U.S. stocks have outperformed foreign stocks by a wide margin, due in large part to the stronger U.S. recovery after the Great Recession. In general, U.S. companies have been more nimble and innovative in response to changing business dynamics, while aging populations in Japan and many European countries have slowed economic growth.1

Despite these challenges, some analysts believe that foreign stocks may be poised for a comeback as other countries recover more quickly from the effects of COVID-19 than the United States. On a more fundamental level, the lower valuations of foreign stocks could make them a potential bargain compared with the extremely high valuations of U.S. stocks.2–3

Global Growth and Diversification

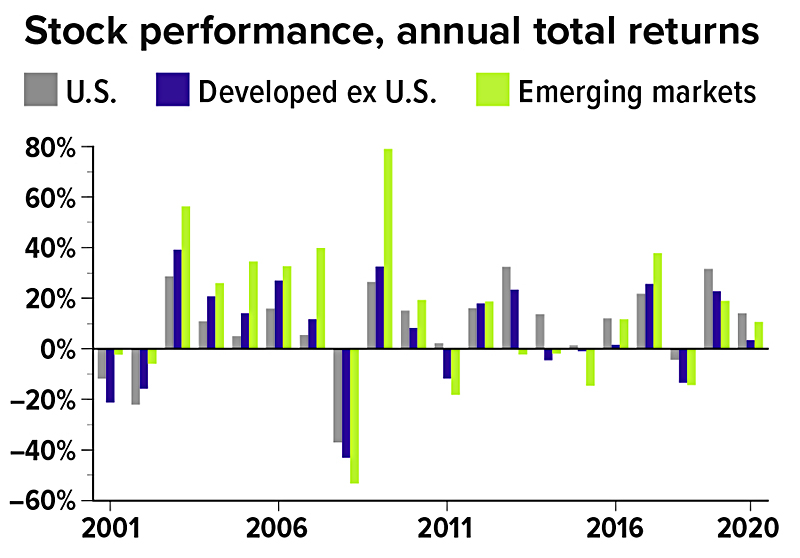

Investing globally provides access to growth opportunities outside the United States, while also helping to diversify your portfolio. Domestic stocks and foreign stocks tend to perform differently from year to year as well as over longer periods of time (see chart). Although some active investors may shift assets between domestic and foreign stocks based on near- or mid-term strategies, the wisest approach for most investors is to determine an appropriate international stock allocation for a long-term strategy.

A World of Choices

The most convenient way to participate in global markets is by investing in mutual funds or exchange-traded funds (ETFs) — and there are plenty of choices available. In Q1 2021, there were more than 1,400 mutual funds and 600 ETFs focused on global equities.4

International funds range from broad, global funds that attempt to capture worldwide economic activity to regional funds and those that focus on a single country. Some funds are limited to developed nations, whereas others may focus on nations with emerging economies.

The term "ex U.S." or "ex US" typically means that the fund does not include domestic stocks. On the other hand, "global" or "world" funds may include a mix of U.S. and international stocks, with some offering a fairly equal balance between the two. These funds offer built-in diversification and may be appropriate for investors who want some exposure to foreign markets balanced by U.S. stocks. For any international stock fund, it's important to understand the mix of countries represented by the securities in the fund.

Additional Risks and Volatility

All investments are subject to market volatility, risk, and loss of principal. However, investing internationally carries additional risks such as differences in financial reporting, currency exchange risk, and economic and political risk unique to a specific country. Emerging economies might offer greater growth potential than advanced economies, but the stocks of companies located in emerging markets could be substantially more volatile, risky, and less liquid than the stocks of companies located in more developed foreign markets.

Domestic vs. Foreign

Over the past 20 years, stocks in emerging markets have outperformed U.S. stocks but have been much more volatile. Stocks of developed economies outside the United States have yielded less than domestic stocks over the 20-year period, but have outperformed in nine of those 20 years.

Source: Refinitiv, 2021, for the period 12/31/2000 to 12/31/2020. U.S. stocks are represented by the S&P 500 Composite Total Return Index, developed ex US stocks are represented by the MSCI EAFE GTR Index, and emerging market stocks are represented by the MSCI EM GTR Index; all are considered representative of their asset classes. The performance of an unmanaged index is not indicative of the performance of any specific investment. Individuals cannot invest directly in an index. Rates of return will vary over time, especially for long-term investments. Past performance is not a guarantee of future results. Actual results will vary.

Diversification is a method to help manage risk; it does not guarantee a profit or protect against loss. The return and principal value of all stocks, mutual funds, and ETFs fluctuate with changes in market conditions. Shares, when sold, may be worth more or less than their original cost. Supply and demand for ETF shares may cause them to trade at a premium or a discount relative to the value of the underlying shares.

Mutual funds and ETFs are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.