Municipal Bonds: A Tax-Advantaged Way to Put Capital to Work

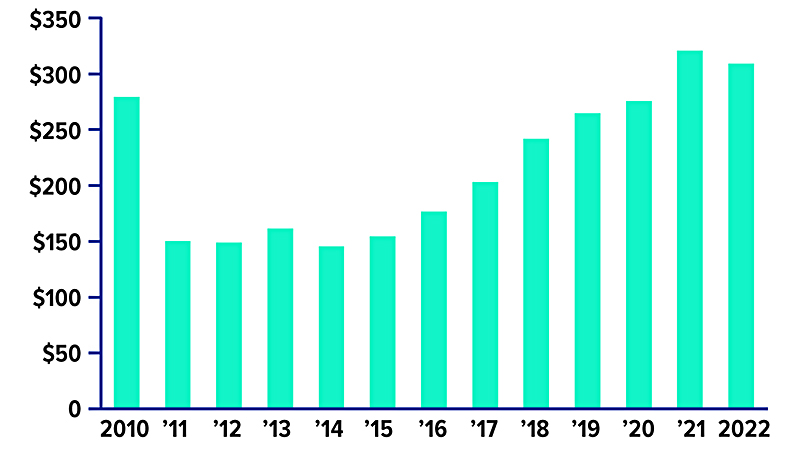

Municipal bonds are issued by public entities such as state and local governments, health systems, universities, and school districts to help finance the building and maintenance of infrastructure projects such as roads, airports, water systems, and facilities. Despite the higher borrowing costs that resulted from the Federal Reserve's inflation-fighting interest-rate hikes, municipalities issued $308 billion in debt in 2022 to fund capital projects, after selling more than $321 billion in 2021.1

At present, many municipalities are in solid financial shape, due to an influx of pandemic stimulus funds and increased income and property tax revenues. Over the longer term, a federal infrastructure bill passed in 2021 is expected to provide additional money for capital projects and help boost municipal credit quality.2

This means that investors might be able to tap into the higher yields being offered on muni bonds without taking on greater risk. The yield on the Bloomberg Muni Benchmark 30Y Index, a common benchmark, rose to 3.6% at the end of 2022, after starting the year at just 1.5%.3

Municipal bonds issued for new projects, in billions

Source: Refinitive, 2023

Accounting for Taxes

The interest paid by municipal bonds is generally exempt from federal income tax, as well as from state and local taxes if the investor lives in the state where the bond was issued. For this reason, muni bonds and tax-exempt funds have long been a mainstay in the portfolios of income-focused investors who want to manage their tax burdens.

The taxable equivalent yield is the pre-tax yield that a taxable bond must offer for its yield to be equal to that of a tax-exempt muni bond. Tax-free yields are often more valuable to investors in higher tax brackets, and they have become especially appealing in high-cost states now that the federal deduction for state and local taxes is limited to $10,000 a year.

For example, a 5% tax-free yield is equivalent to a taxable yield of about 7.9% for an investor in the 37% bracket and 6.6% for an investor in the 24% tax bracket. Exemption from state income taxes would increase the equivalent yield.

Investors should keep in mind that capital gains taxes could still be triggered if tax-exempt bonds or fund shares are sold for a profit. Also, tax-exempt interest is included in determining whether a portion of any Social Security benefit received is taxable. Some muni bond interest could be subject to the alternative minimum tax.

Reviewing the Risks

Because government entities have the power to raise taxes and fees as needed to pay the interest, muni bonds generally carry lower risk than corporate bonds. From 1970 through 2021, the 5-year default rate for U.S. municipal bonds was 0.08%, compared with 6.8% for global corporates.4

Regional economies and the financial strength of issuers can vary widely, so municipal issues are rated for credit risk, as are other bonds. A credit rating ranging from AAA down to BBB (or Baa) is considered "investment grade"; lower-rated or "high yield" bonds carry greater risk.

As interest rates rise, bond prices fall, and vice versa. When redeemed, bonds may be worth more or less than their original cost. Bond funds are subject to the same inflation, interest-rate, and credit risks associated with their underlying bonds. The return and principal value of bonds and mutual fund shares fluctuate with changes in interest rates and other market conditions, which can adversely affect investment performance.

The performance of an unmanaged index is not indicative of the performance of any specific security. Individuals cannot invest directly in any index. Past performance is no guarantee of future results. Actual results will vary.

Mutual funds and ETFs are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.