Decisions, Decisions: Weighing the Pros and Cons of an IRA Rollover

If you lose a job, switch employers, or step into retirement, you might consider rolling your retirement plan savings into an IRA. But this isn't your only option; it could make more sense to keep the money in your previous employer's plan or move it to your new employer's plan (if allowed by the plan).

You could also cash out, but that's rarely a good idea. Withdrawals from tax-deferred retirement accounts are taxed as ordinary income, and you could be hit with a 10% tax penalty if you are younger than 59½, unless an exception applies.

Some employer plans permit in-service distributions, which allow employees to take a partial distribution from the plan and roll the money into an IRA. When deciding what to do with your retirement assets, be aware that IRAs are subject to different rules and restrictions than employer plans such as 401(k)s.

What IRAs Have to Offer

There are many reasons to consider an IRA rollover.

Investment choice. The universe of investment options in an IRA is typically much larger than the selection offered by most employer plans. An IRA can include individual securities and alternative investments as well.

Retirement income. Some employer plans may require you to take a lump-sum distribution when you reach the plan's retirement age, and your distribution options could be limited if you can leave your assets in the plan. With an IRA, it's likely that there will be more possibilities for generating income, and the timing and amount of distributions are generally your decision [until you must start taking required minimum distributions (RMDs) at age 72].

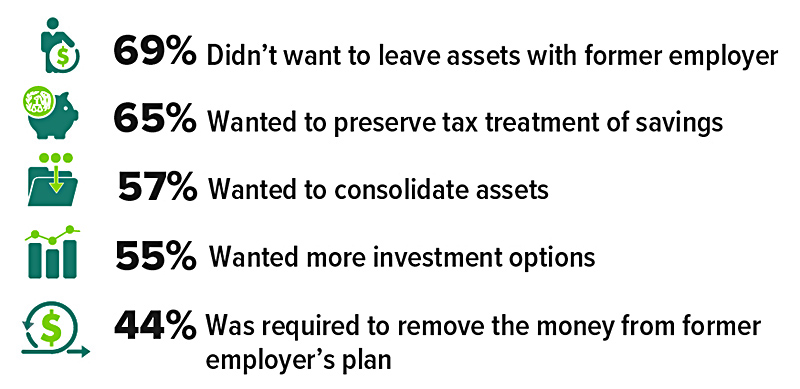

Top Reasons for Most Recent IRA Rollover

Source: Investment Company Institute, 2021 (more than one reason allowed per respondent)

Account consolidation. Consolidating your investments into a single IRA may provide a clearer picture of your portfolio's asset allocation. This could make it easier to adjust your holdings as needed and calculate RMDs.

Different exceptions. There are circumstances when IRA owners may be able to withdraw money penalty-free prior to age 59½, options that are not available to employer plan participants. First-time homebuyers (including those who haven't owned a home in the previous two years) may be able to withdraw up to $10,000 (lifetime limit) toward the purchase of a home. IRA funds can also be withdrawn to pay qualified higher-education expenses for yourself, a spouse, children, or grandchildren. IRA funds can even be used to pay for health insurance premiums if you are unemployed.

When to Think Twice

For some people, there may be advantages to leaving the money in an employer plan.

Specific investment options.Your employer's plan may offer investments that are not available in an IRA, and/or the costs for the investments offered in the plan may be lower than those offered in an IRA.

Stronger creditor protection. Most qualified employer plans receive virtually unlimited protection from creditors under federal law. Your creditors cannot attach your plan funds to satisfy any of your debts and obligations, regardless of whether you've declared bankruptcy. On the other hand, IRAs are generally protected under federal law (up to $1,362,800) only if you declare bankruptcy. Any additional protection will depend on your state's laws.

The opportunity to borrow from yourself. Many employer plans offer loan provisions, but you cannot borrow money from an IRA. The maximum amount that employer plan participants may borrow is 50% of their vested account balance or $50,000, whichever is less.

Penalty exception for separation from service. Distributions from your employer plan won't be subject to the 10% tax penalty if you retire during the year you reach age 55 or later (age 50 for qualified public safety employees). There is no such exception for IRAs.

Postponement of RMDs. If you work past age 72, are still participating in your employer plan, and are not a 5% owner, you can delay your first RMD from that plan until April 1 following the year in which you retire.