Rising Interest Rates

After dropping the benchmark federal funds rate to a range of 0%–0.25% early in the pandemic, the Federal Open Market Committee (FOMC) of the Federal Reserve has begun raising the rate aggressively in response to high inflation. Raising the funds rate places upward pressure on a wide range of interest rates, including the prime rate, small-business loans, home-equity lines of credit, auto loans, credit-card rates, and adjustable-rate mortgages (with indirect pressure on fixed-rate mortgages).

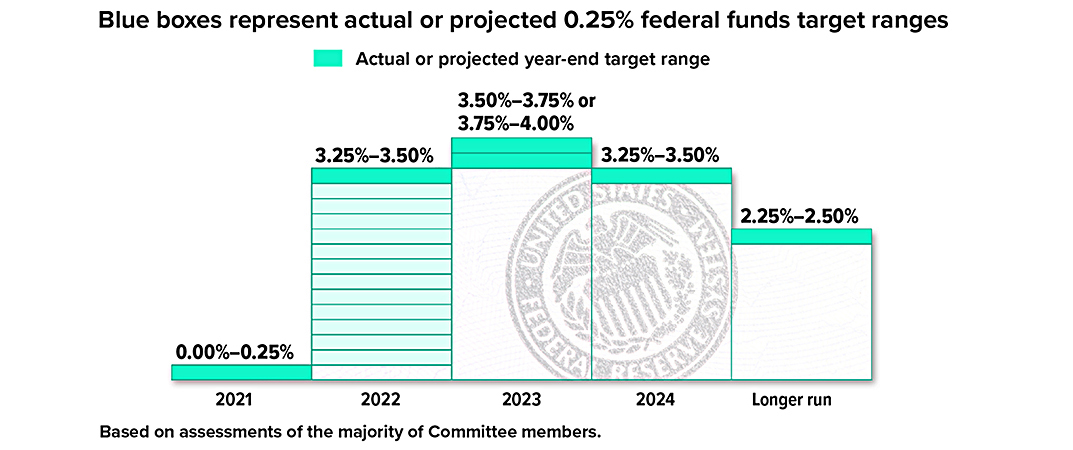

This chart illustrates the federal funds target range at the end of 2021 and future year-end projections released after the FOMC June 2022 meeting, when the Committee raised the range to 1.50%–1.75%.

Source: Federal Reserve, June 2022. These are only projections, based on current conditions, subject to change, and may not come to pass.